Avoid the black swans

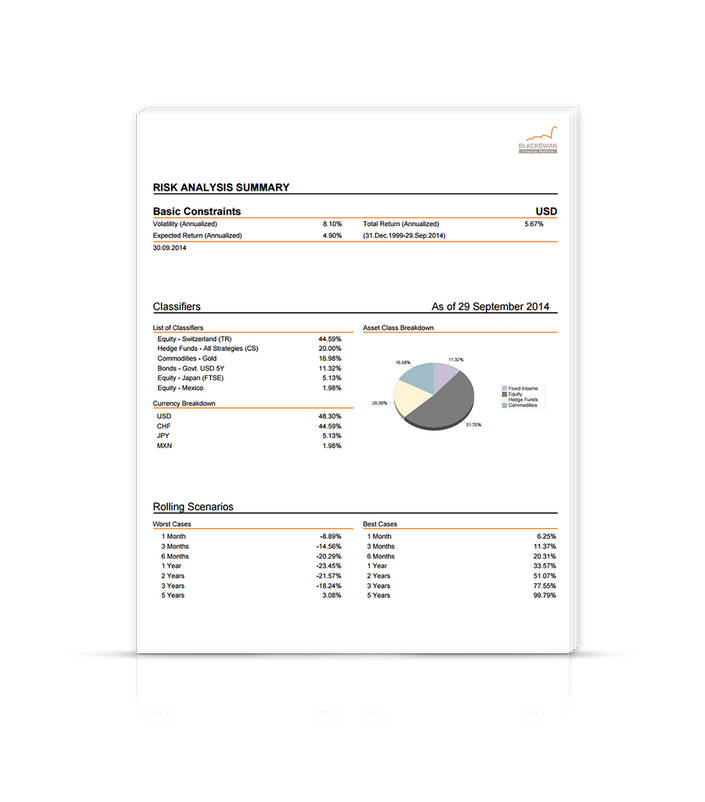

BlackSwan helps you avoid extreme events through sophisticated quantitative risk metrics and accurate distributions. Its built-in market risk module is constantly evolving and back-tested to ensure it remains relevant to prevailing market risks. It provides for a number of risk metrics such as value-at-risk, volatility, expected shortfall and tracking error. It also includes a range of built-in risk-related analyses, including metric analysis, allocation analysis, volatility analysis and Monte Carlo models.

Asset Allocation

Identify the risk profile of your portfolio and propose the optimal asset allocation based on your risk preferences. The portfolio optimization tool seeks to minimize risk metrics such as volatility, tracking error, parametrical and historical expected shortfall, Monte Carlo expected shortfall and maximum drawdown.

Visualize graphically your portfolio’s components, benchmarks and credit risks and test in real time how the risks are being reduced. Users can also change economic factors in real time to test how their portfolio would react to various changes in the economic outlook.

Risk Management

We know that computing different risk metrics such as volatility, VaR and expected shortfall are the fundamentals of risk management. However such measures are abstract and often based on assumptions that may be difficult to understand by the average investor. Our Market Risk module helps you explain these assumptions by basing the quantitative finance calculations on concrete economic factors that clients can evaluate. The advanced models support fat-tailed distribution, historical simulation and Monte-Carlo simulations. It can also accurately compute your credit exposure and understand the risk contribution to your portfolios by financial instrument, asset class, industry sector and currency.

Factor Model

The factor model accurately identifies the Beta of your portfolio, giving you a quick view of how your own returns will fare against those of the market. In addition, it aids you in explaining to the customer the impact of other sources of risk such as economic factors and idiosyncratic risk. Gain a more accurate prediction for the performance of your portfolio by incorporating economic forecasts and identifying relevant seasonal trends so as to better understand the movements of your assets.

Volatility Estimation

Volatility is an ongoing issue for everyone in the financial industry. This module allows you to measure volatility in a timelier manner, by looking at the economic cycles of the assets in your portfolio. Using the same data, you can easily explain to customers the changes in volatility occurring at any one time. The volatility can be measured using historical, EWMA or GARCH methods.

Portfolio Analysis

BlackSwan allows you to manage your portfolio models in accordance with your Investment strategies. It suggests the most suitable portfolio for each and every risk profile and can be configured with trigger rules to automatically attach new assets when desired.

Analyze the statistics behind each of your portfolios and see how they measure up against a benchmark of your choosing. Then, graphically and dynamically explain to your clients their portfolio’s Alpha, where it sits on the efficient frontier, and its key indicators such as its risk metrics and other statistics.

BlackSwan can be fully integrated to Prospero 365 or to third party Portfolio Management Systems (via its API) to offer seamless Portfolio risk Analysis of all your portfolios.

Reports

BlackSwan provides a full range of reports which are fully customizable to your requirements, including: Historical Performance, Statistics, Factor Model, Benchmarks, Asset Allocation, Risk Metrics, Risk Contribution, Monte Carlo Simulation.